How much will my Life Insurance premiums be?

The short answer to that is “it depends” and the long answer is that it depends on a number of factors about yourself in addition to what type of policy you’d like to get. For example, the premiums for a 10-year term will usually be lower than a 30-year with all the other variables being the same.

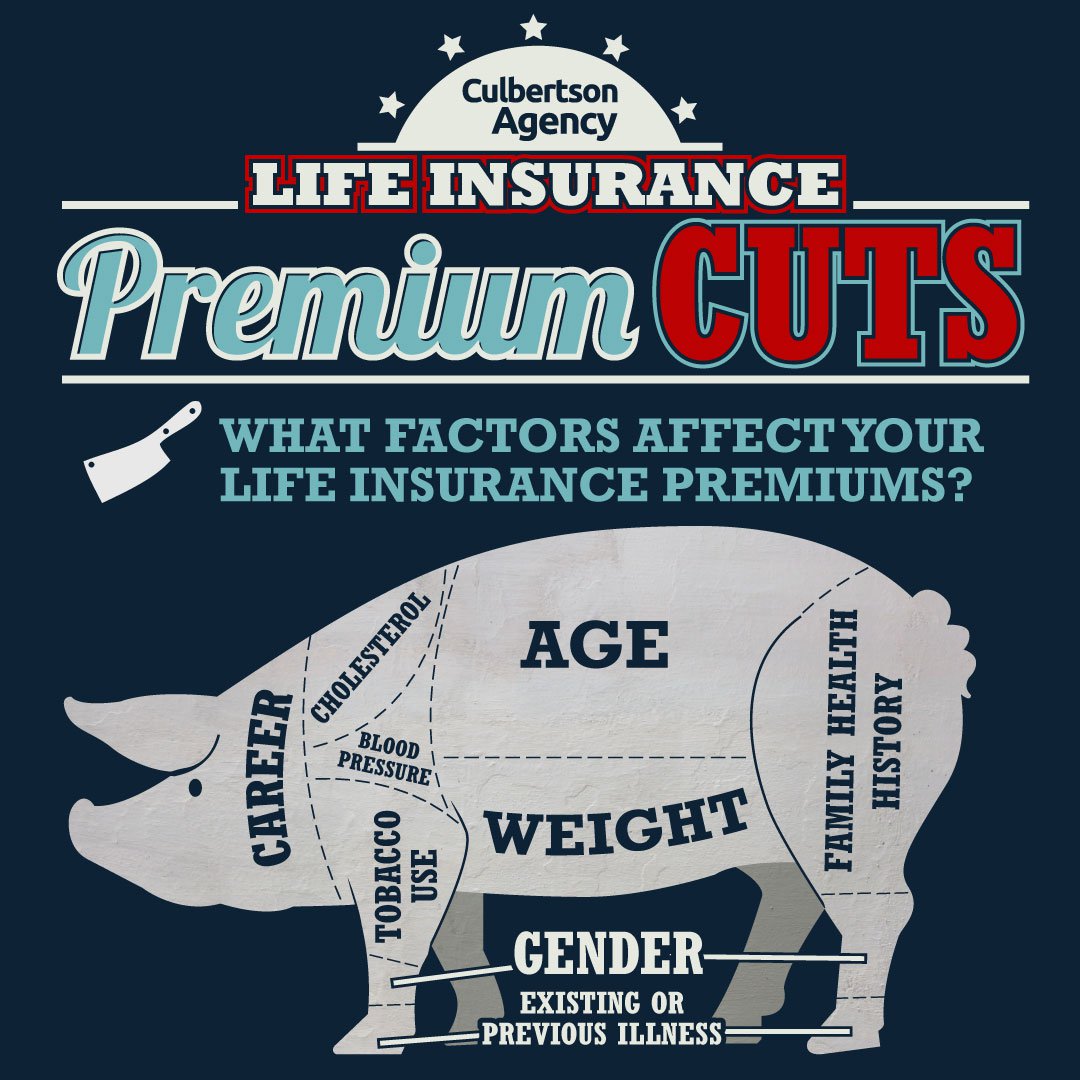

What are those other variables? The following is a list of things that will contribute to how high or low your insurance premium will be:

Age

It’s always cheaper to take out a policy when you’re younger, since you’re more likely to be in better shape than when you’re older. The earlier you can get life insurance, the sooner you can lock in a better rate.

Gender

Statistics have shown that women tend to live longer than men, as they have better health lifestyles and diets. Men also tend to have more dangerous jobs than women.

Tobacco Use

If you use cigarettes or smokeless tobacco, it will definitely affect your life insurance premiums. In most cases, it could cause your premiums to be about double what they would be if you didn’t smoke.

Career

High-risk professions can increase your insurance premiums. High-risk industries include fishing, mining, construction, forestry, agriculture, and transportation.

Weight

No one likes to talk about their weight, but life insurance agents will need to ask for your weight because overweight people are statistically more prone to health problems, such as diabetes and heart disease.

Family Health History

If any of your family members has ever suffered from a serious medical condition, life insurance agents take this into account because there is a chance you might also suffer from these health issues.

Blood Pressure, Existing Illness, and Cholesterol

Applicants with certain health conditions may be viewed as high-risk. Let your life insurance agent know if you are managing your conditions well, and you may be able to get a lower, preferred rate for your coverage.

Which two factors most increase a life insurance premium?

The two factors that most increase a life insurance premium are the age and health of the individual.

- Age: The older an individual is, the higher the risk for the insurance company, and thus, the higher the premium. This is because as people age, the likelihood of them needing to use their insurance increases.

- Health: Individuals with pre-existing conditions or a history of serious health issues are likely to have higher premiums. This includes conditions like heart disease, cancer, diabetes, high blood pressure, and others. If you’re a smoker or have a high-risk occupation or hobby, this can also increase your premium.

These factors are used by insurance companies to determine the risk associated with insuring an individual. The higher the risk, the higher the premium. They need to balance the risk of paying out a large sum early (if the policyholder dies prematurely) against the potential profit to be made from years of collected premiums.