Are you a Florida homeowner in need of protection against the upcoming hurricane season?

Though preparing for such an event can seem overwhelming, understanding your homeowners insurance policy is essential to ensuring that you and your family have the resources needed to stay safe and recover from any damage.

In this blog post, we’ll go over everything you need to know about FL homeowners insurance and help you prepare for potential risks during hurricane season so that when the time comes, you can feel secure knowing your property is protected.

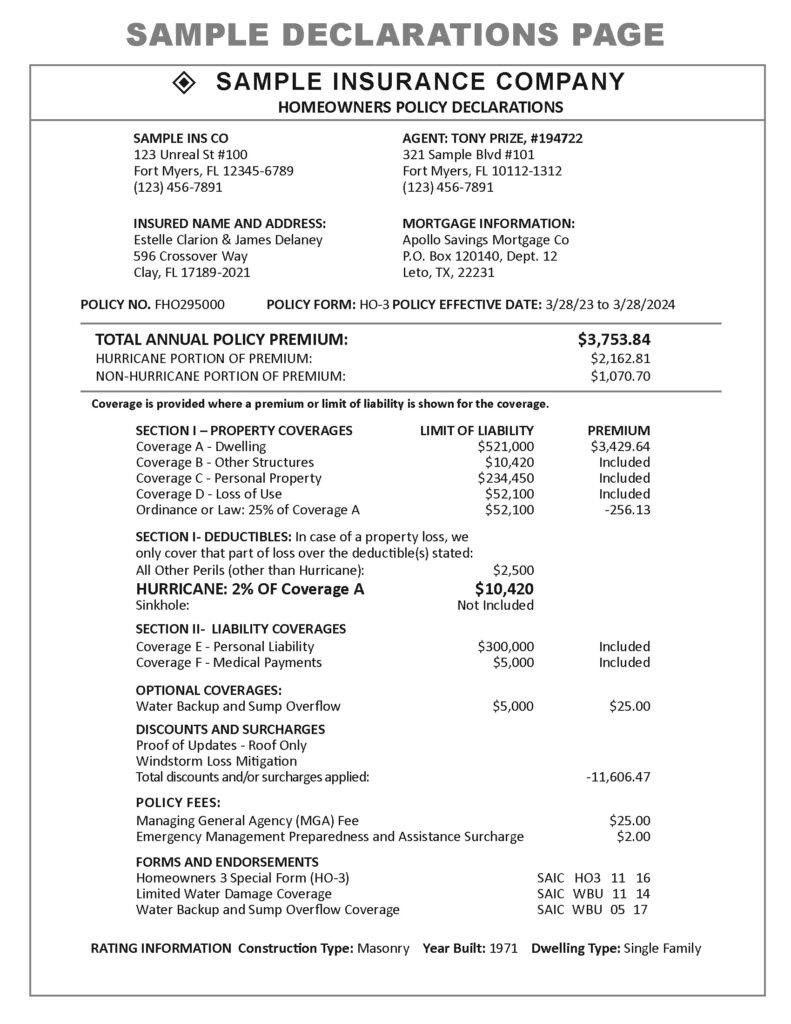

Overview of Homeowners Policy Declarations

This page provides a summary of your coverage, including the property and liability limits, deductibles, and endorsements that have been added to your policy. It’s important to review this information carefully to ensure that you have the coverage you need in case of a loss or damage to your home.

The Declarations page can also provide information about discounts you may be eligible for and any special conditions that may apply to your coverage. Taking the time to understand your homeowners policy Declarations can help you make informed decisions about your insurance coverage and give you peace of mind that you’re protected in the event of the unexpected.

The above sample homeowners insurance policy declarations page is based on one proved by MyFloridaCFO.com.

Total homeowners insurance annual policy premium

This premium is the amount you will pay annually to maintain your insurance policy. It is determined by a variety of factors such as the value of your home, the level of coverage you require, and your deductible amount. It is important to note that while many factors contribute to the cost of your policy, the level of coverage you choose is a critical one. Opting for lower coverage may initially save you money on your premium, but it could ultimately cost you more in the event of a claim. Understanding your total annual policy premium and the factors that impact it is a key step in protecting your home and your investment.

Section I – Property Coverages

Section I of your homeowners insurance policy covers your property, including your dwelling, personal property, and other structures on your property such as garages or sheds. It’s important to review the coverage limits and deductibles for each category to ensure you have adequate protection. In the event of a covered loss, your insurance company will evaluate the damage and provide compensation up to the coverage limit. Understanding the details of your policy can help you make informed decisions about your coverage needs and provide peace of mind knowing that you are protected.

Coverage A – Dwelling

Coverage A – Dwelling specifically covers the cost to repair or rebuild the physical structure of your home in case of damage caused by covered events such as fire, windstorm, or hail. It also covers structures attached to the home such as a garage, deck, or porch. It’s important to note that this coverage is based on the replacement cost of the home, not the market value. This means the coverage is designed to help you rebuild after a covered event and not just replace your home’s current market value. To ensure you have adequate coverage, it’s important to have your home reassessed from time to time to make sure your coverage keeps up with any changes in the home’s value.

Coverage B – Other Structures

This coverage protects structures that are not attached to your primary dwelling, such as a detached garage, fence, or shed. While Coverage A protects your main dwelling, Coverage B ensures that other important and valuable structures on your property are covered in case of damage or loss. It’s essential to review the specifics of your coverage and make sure you have adequate protection for all of the structures on your property. By understanding what’s included in Coverage B, you can have peace of mind knowing that your entire property is protected.

Coverage C – Personal Property

Coverage C, or personal property coverage, plays a crucial role in safeguarding your belongings in the event of damage or theft. This type of coverage typically includes items such as furniture, clothing, electronics, and other personal possessions. The amount of coverage you’ll need will depend on the total value of your belongings, so it’s important to conduct a thorough inventory and keep track of any high-value items. By taking the time to understand your personal property coverage, you can rest assured that your most cherished possessions are protected.

Coverage D – Loss of Use

Coverage D, also known as Loss of Use, is one of the lesser-known components of a policy. Essentially, this coverage helps with the additional expenses you may incur if you are forced to temporarily leave your home due to damage or destruction caused by a covered event. This includes things like hotel or rental expenses, additional dining costs, and even laundry expenses. Understanding what is covered under Loss of Use can give homeowners peace of mind in the event of an unexpected circumstance, and can help mitigate financial stress during a difficult time.

Ordinance or Law: 25% of Coverage A

One important regulation to keep in mind is the 25% coverage law. This mandates that insurance policies should cover a minimum of 25% of your home’s value in the event of damage or destruction. For example, if your home is valued at $500,000, your policy should provide coverage for at least $125,000. Knowing this information can provide peace of mind and help you make informed decisions when selecting homeowners insurance coverage. It’s always smart to review your policy regularly and consult with a professional to ensure you’re fully protected.

Section I – Deductibles

This section outlines the amount you’ll pay out of pocket before your insurance coverage kicks in. It’s important to choose a deductible that you’re comfortable with and that fits within your budget. Additionally, some insurance policies offer different deductible options for different types of damage, such as wind or hail damage. Make sure you understand the specifics of your policy and don’t be afraid to ask questions if anything is unclear. Understanding your deductible can help you make informed decisions and ensure you’re properly protected in the event of unforeseen damage.

Hurricane Deductible: 2% of Coverage A

If your policy includes a hurricane deductible, you can expect to pay a percentage of your coverage amount before your insurance company steps in to cover the rest of the damages. In this case, a 2% deductible means that if your home is insured for $300,000 and you experience $30,000 in damages from a hurricane, your out-of-pocket cost would be $6,000 (or 2% of $300,000). Understanding these details ahead of time can help you make informed decisions and feel confident that you have the proper coverage in the event of a natural disaster.

Section II – Liability Coverages

Section II of the declarations page covers liability coverages, which is crucial for protecting yourself from unforeseen events. The liability coverage portion of your policy will come into play if someone is injured on your property and decides to sue you, or if you accidentally damage someone else’s property. Understanding your coverage limits and what is covered is essential for protecting your assets, and can bring you peace of mind. Don’t let the declarations page intimidate you, take the time to thoroughly read through it and ask questions if you need further clarification.

Coverage E – Personal Liability

This coverage protects you in case someone is injured on your property or if you accidentally damage someone else’s property. It can also provide legal defense if someone sues you for those types of incidents. It’s crucial to make sure you have enough liability coverage to protect yourself and your assets. Don’t hesitate to speak with your insurance agent if you have any questions or concerns about your policy declarations page.

Coverage F – Medical Payments

This coverage is meant to provide a safety net in case someone is injured on your property, regardless of who is at fault. It can help cover medical bills, ambulance fees, and even legal expenses if the injured party decides to sue. While the coverage limit is typically much lower than other parts of your policy, it’s still an important aspect to understand – especially if you regularly have visitors to your home.

Optional Coverages: Water Backup and Sump Overflow

This coverage provides protection in the event of damage caused by water backup or overflow from your sump pump. Although this add-on may not be necessary for every homeowner, those in flood-prone areas or with finished basements may want to consider adding it to their policy for added peace of mind. Knowing what coverage is available can help you make an informed decision about what protection you need for your home.

Discounts and surcharges

These can greatly impact your premium, so it’s important to know what they mean. Discounts may be offered for things like having a home security system or bundling your insurance policies. On the other hand, surcharges may be applied for having a high-risk property or making frequent claims. Understanding the declarations page and the discounts and surcharges listed can help you make informed decisions about your homeowners insurance policy.

Policy Fees

Policy fees are typically a one-time charge that covers the administrative costs associated with setting up your policy. They can range in cost and are often included in your overall premium. It is important to review your policy fees and understand what they cover so that you are not caught off guard by unexpected charges. Additionally, if you have any questions about your policy fees or any other aspect of your homeowners insurance policy, do not hesitate to reach out to your insurance provider for clarification.

Forms and Endorsements

Understanding the declarations page of your homeowners insurance policy can seem daunting at first, but it is a crucial part of ensuring that your investment is protected. The declarations page outlines important information such as your policy limits, premiums, and deductibles. Additionally, forms and endorsements may be included to specify additional coverage or exclusions. It’s important to read through this section carefully and make note of any questions or concerns you may have. By staying informed and understanding the ins and outs of your policy, you can feel confident in your coverage and rest easy knowing that you’re prepared for any unforeseen events that may arise.

Understanding your FL homeowners insurance policy is essential in preparation of hurricane season. This blog post has provided a comprehensive overview of the policy declarations and coverage sections including Coverage A-D, Hurricane Deductibles, Liability Coverage E-F, optional coverages, discounts & surcharges, and forms, and endorsements.

We hope that this post on understanding your FL homeowners insurance policy has provided useful information to help you confidently navigate the complex processes associated with homeowners insurance policies.

As hurricane season approaches closer, we encourage you to explore other posts in our hurricane season prep series to further protect yourself and your family from storm related damages. As always, speak with an experienced independent agent at Florida Insurance Solution for any questions or concerns regarding your coverage options.

Check out our other posts in our hurricane season prep series to further safeguard yourself as the windy season nears!